Risk Management Guide: Five Steps to Success

- Phillip Ewen

- Nov 23, 2022

- 3 min read

Risk Management Planning

So firstly what is 'Risk'? We need to understand the term of risk to be positioned to manage it. Risk is defined as 'the probability or threat of damage, injury, loss, or any other negative occurrence that is caused by external or internal vulnerabilities, and that may be avoided through proactive response or activity'.

Let's explore the below five risk management elements on establishing a good basis for effective risk planning, treatment and mitigation.

1. Defining Risk Management and its Objectives

2. The Importance of Developing a Risk Management Plan

3. The Components of a Risk Assessment

4. The Process of Developing a Risk Management Plan

5. The Benefits of Broader Risk Insights

1. Risk Management is the process of identifying, assessing, and managing risks to ensure they are within an organisation's operational tolerances. These activities are about methodically exploring and identifying opportunities to discover error, loss or improvement pathways. We Caution the word 'Operational Tolerance' in this blog, as there are many standing legal and ethical positions established in every jurisdiction, which detail what a business' duties and obligations must look like to operate.

2. The realities of operating a business is that 'Risks and Hazards' will always exist! This doesn't mean that organisations can't work towards minimising, mitigating, treating or eliminating them from their business in a planned, systematic and progressive manner. Organisations face a variety of risks, from a diverse array of internal and external elements. An organisations' first view of risk is usually focused on those physically observed that impact on the work, assets or people of an organisation. We must not overlook that there are a range of several other elements [Commercial, Financial, Operational, Psychosocial, Environmental, Security, Legal & Regulatory] of risk which need the same rigor given the likely position to leave your business exposed to undesirable outcomes. By identifying and assessing our risks, organisations can be positioned to make informed decisions about how to best approach and treat these conditions of operation.

3. There are 'Five' components to the assessment of risk :

Identification

Analysis

Evaluation/Quantification

Risk Treatment

Monitor and Review

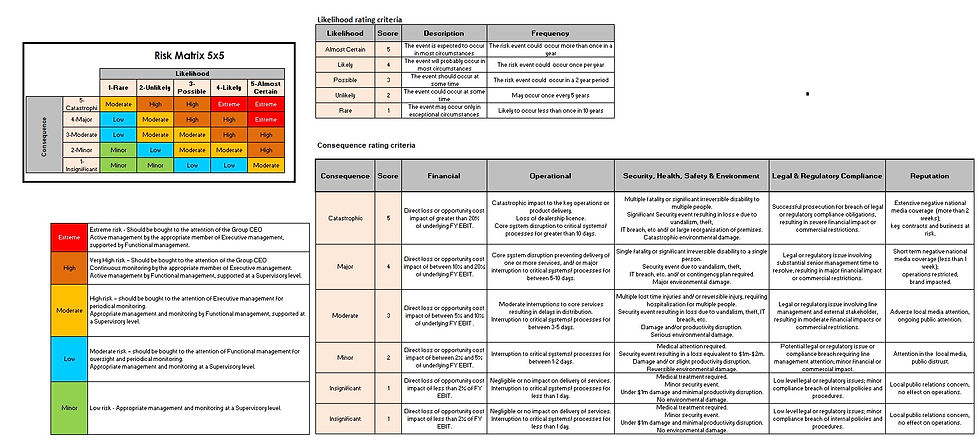

4. Each stage of the assessment is important in its own right to help you determine your organisations risk position and course of action to these insights. Identification is the first step in risk assessment process. An organisation will be required to identify the risks that are present within their business. This is done through a range of information sources, including personal insights, risk workshops, informal dialogue, field observations, interviews, and surveys. Once your business has identified its evident risk profile, these will need to analysed. This means evaluating each risk and determining its potential impact to your business, additionally determining the likelihood of the risk occurring. This is quantified through the use of a Risk Matrix [Example: Risk Matrix 5x5] which is a quantification tool to rank risk. After your business has analysed its risk profile these will need to be prioritise by assessing which have the highest residual value, probability or severity of exposing the business to loss or error events. This means making a informed decision on what risks are priority to focus organisational resources on and what can be monitored/managed until resourcing permit action. The final stage of assessing risk is the development of a set of response, actions and activities to address each exposure with aim to reduce it foreseeable impact to the business. This is normally stated as your action plan or strategy. This Plan/Strategy is to include what your organisation immediately 'has' or 'will do' to prevent the risk from occurring and what you 'plan to do' to minimise those exposures being present in the future.

5. So having gained a broad understanding of risk, its assessment and management we must review if the right people, information and inputs have been included into our assessment position. More often we find ourselves missing the most vital part of risk management which is unbiased assessment and 'consultation'. Your plan can only be as good as the information being inputted into it! Limiting the inputs creates information bias within the assessment, which leads to organisational condition of risk oversight. Our risk plan must include a diverse range of relevant observation, prospective and stakeholders to assure a true representation of the organisation risk profile. At Progressus we refer to this as the 'Operational Realities' and this reality need to be clear, thorough and representative of the organisational conditions. The more we can be assured that our activity are treating the right operational conditions the more we can be assured the delivery of true risk reduction.

Hopefully this short read assists your business in finding some simple insights into Risk Management. If you are wanting more depth or insight, please engage us at Progressus Solutions, where we will assist you in exploring your queries on risk profiling and the systematic management of your exposure to prevent your business from incurring injury, error or loss.

Comments